Payment rails are the infrastructure that enables the transfer of money between banks, payment service providers, and other financial institutions. For businesses, choosing the right payment rail depends on factors like speed, cost, geography, and customer satisfaction.

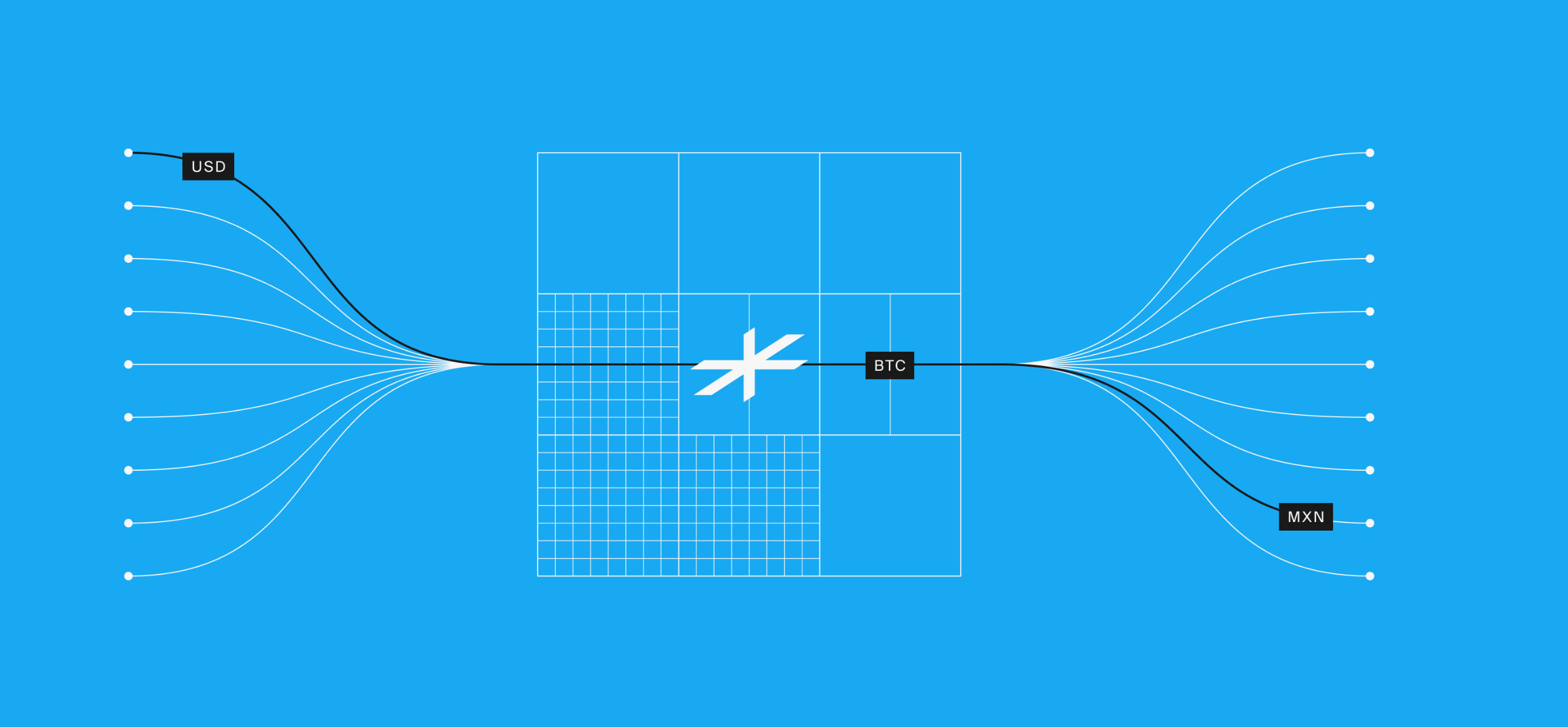

Zelle and PayPal are two prominent examples of payment rails, each offering unique features and benefits. Lightspark is trying to move past these traditional payment rails by introducing a new category of global payments infrastructure called the 'Money Grid'.

The Payment Rail Landscape

Payment rails are crucial for transferring money between parties. However, current systems can be slow, fragmented, and costly, often leading to inefficiencies and higher expenses for businesses and consumers alike.

Understanding Zelle and PayPal

How Zelle Works

Zelle® is a digital payment service that allows users to send and receive money quickly between U.S. bank accounts. Users enroll through their bank's online or mobile platforms, linking their account with an email or mobile number. The process involves adding a recipient, selecting send or request, and confirming details. Transactions are typically completed within minutes. Zelle® relies on secure banking platforms and digital notifications for processing. Payments are irreversible once sent, emphasizing the need for trusted recipients. The service is integrated into banks like Wells Fargo, ensuring a seamless user experience.

Strengths and Limitations of Zelle

Strengths

- Zelle offers instant transfers, typically completing transactions within minutes.

- There are no fees for sending or receiving money through Zelle, making it a cost-effective option.

- Zelle is integrated with many major U.S. banks, allowing users to send money directly from their bank’s app without needing a separate Zelle app.

Limitations

- Zelle is only available for domestic transactions within the United States.

- There is no purchase protection, meaning payments cannot be reversed once sent.

- Zelle does not support international payments or currency exchanges, limiting its use for global transactions.

How PayPal Works

PayPal operates as an online payment system allowing users to send and receive money globally. Users link their credit card, debit card, or bank account to their PayPal account, creating a digital wallet. The transaction process involves selecting PayPal at checkout or entering the recipient's email/phone, choosing a payment method, and completing the transaction with encrypted data. Funds are instantly available in the recipient's PayPal balance. PayPal uses encryption, early fraud detection, and app alerts for security. The platform integrates with various payment networks and supports direct deposit, cryptocurrency, and high-yield savings accounts.

Strengths and Limitations of PayPal

Strengths

- PayPal offers global reach, allowing users to send and receive money in over 200 countries and supporting multiple currencies.

- It provides versatile payment options, including credit cards, debit cards, bank transfers, and PayPal account funds.

- PayPal ensures robust security with encryption, fraud detection, and Purchase Protection on eligible transactions.

Limitations

- PayPal has a complex and often high fee structure, including fees for currency conversions and certain transactions.

- International transfers can be costly due to a 3-4% currency conversion markup.

- Account issues such as unexplained freezes and restrictions can occur, impacting access to funds.

Zelle and PayPal Compared

Transaction Speed

Zelle offers near-instant transfers, typically completing transactions within minutes due to its integration with U.S. banks. PayPal's transaction speed varies; while transfers between PayPal accounts are instant, bank withdrawals and currency conversions can take 3-5 days. Lightspark, leveraging the Lightning Network, promises real-time, instant payments globally.

Fees

Zelle is generally free for users, though some banks may charge small fees. PayPal has a complex fee structure, including charges for currency conversions and certain transactions. Lightspark emphasizes low-cost transactions, moving money at a fraction of today's costs without hidden fees.

Cross-Border Capabilities

Zelle is limited to domestic transactions within the U.S. and does not support international payments. In contrast, PayPal operates in over 200 countries and supports multiple currencies, albeit with high fees. Lightspark offers seamless, low-cost cross-border payments, supporting 140+ countries and 120+ currencies.

Security Protocols

Zelle employs bank-level security but lacks fraud protection and fund recovery options. PayPal offers robust security with encryption, fraud detection, and Purchase Protection. Lightspark ensures secure transactions through the decentralized Bitcoin network and self-custodial wallets.

Operational Hours

Zelle transactions are available 24/7 through participating banks' apps. PayPal also operates around the clock, though ACH transfers are limited to business hours. Lightspark's infrastructure is designed for continuous, uninterrupted operation, enabling 24/7 payments globally.

How Zelle And PayPal Are Used

Domestic Peer-to-Peer Payments

Zelle is ideal for quick, fee-free domestic transfers between U.S. bank accounts, making it suitable for splitting bills or paying rent. PayPal offers more flexibility with payment methods but incurs fees. Lightspark provides instant, low-cost payments with no hidden fees, making it a superior option for seamless transactions.

International Transfers

PayPal supports international payments in multiple currencies but charges high fees and currency conversion markups. Zelle is limited to U.S. transactions. Lightspark excels with low-cost, real-time cross-border payments, supporting 140+ countries and 120+ currencies, making it the best choice for global transactions.

Business Payments

PayPal offers extensive business tools, including credit card acceptance and eCommerce integration, but at a higher cost. Zelle is suitable for small, domestic businesses needing quick, fee-free transfers. Lightspark provides scalable, compliant solutions with built-in developer toolkits, making it ideal for businesses seeking global reach and low costs.

Security and Fraud Protection

PayPal offers robust security features, including encryption and Purchase Protection, but can freeze accounts unexpectedly. Zelle provides bank-level security but lacks fraud protection. Lightspark leverages the decentralized Bitcoin network for secure, transparent transactions, ensuring both security and reliability without the risk of account freezes.

Time for a New Standard

Lightspark is a global payments infrastructure company that enables real-time, cross-border money movement using Bitcoin, fiat, and stablecoins. Unlike Zelle and PayPal, Lightspark offers instant, low-cost, and secure payments on a global scale.

- Built on Bitcoin: Lightspark’s infrastructure leverages Bitcoin’s open, decentralized foundation, utilizing the Bitcoin Lightning Network for instant, low-cost transactions.

- Instant Settlement: The platform enables real-time, instant settlement of payments globally, ensuring money moves instantly and securely at a fraction of today’s costs.

- Lower fees: Lightspark offers payments at a fraction of current costs, with no hidden fees, reducing operational expenses for digital banks, wallets, and exchanges.

- Cross-border security by default: The infrastructure is designed for secure, cross-border payments, leveraging Bitcoin’s decentralized network to provide reliable transactions across borders.

A Modern Infrastructure

For businesses looking to transcend legacy payment systems like Zelle and PayPal, here’s what Lightspark has to offer:

- Wallets: Build feature-rich digital wallets with flexible custody options, supporting Bitcoin, Lightning, stablecoins, and domestic payment rails.

- Digital Banks: Connect to the 'Money Grid' for real-time, global payments, enabling digital banks to expand into new markets and stay competitive.

- Exchanges: Integrate with the Bitcoin Network to power instant Bitcoin movement, reducing costs and eliminating friction for cryptocurrency exchanges.

- Stablecoins: Launch stablecoins on Bitcoin instantly using Spark, providing a fast, cost-effective way to create, distribute, and monetize digital assets.

Emerging technologies and evolving regulations are reshaping the future of payments. Lightspark offers real-time, low-cost global payments, leveraging Bitcoin’s decentralized network. Don’t just choose between two outdated options—upgrade to a payment rail built for the internet age. Learn more or book a demo.