/knowledge

Real Time Payments India: Rails, Fees, and the Lightning Network (2025)

India's real-time payments system is a model for global finance. This article examines the country's payment rails, regulatory framework, and associated fees, providing a technical guide to one of the world's most advanced payment infrastructures.

Real Time Payments India: Rails, Fees, and the Lightning Network (2025)

Instant Payments Switzerland: Rails, Fees, and the Lightning Network (2025)

Switzerland's adoption of real-time payments introduces new opportunities and technical considerations for businesses. This article explores the country's instant payment system, detailing its payment rails, the regulatory framework, associated fees, and what integration entails for developers.

Instant Payments Switzerland: Rails, Fees, and the Lightning Network (2025)

Bhutan Instant Payments: Rails, Fees, and the Lightning Network (2025)

Bhutan's adoption of real-time payments creates new possibilities in financial technology. This article provides a technical and regulatory overview, covering the country's payment rails, governing policies, fee structures, and integration specifications.

Bhutan Instant Payments: Rails, Fees, and the Lightning Network (2025)

Indonesia Real Time Payments: Rails, Fees, and the Lightning Network (2025)

Indonesia's real-time payments system is rapidly expanding. This article examines the key components for businesses operating in the region, including available payment rails, the regulatory framework, associated fees, and other operational details for successful integration.

Indonesia Real Time Payments: Rails, Fees, and the Lightning Network (2025)

Real-Time Payments UK: Rails, Fees, and the Lightning Network (2025)

Instant transactions are the standard in the UK, powered by sophisticated real-time payment systems. This overview breaks down the core components, including the different payment rails, the regulatory framework, transaction fees, and other operational details for integration.

Real-Time Payments UK: Rails, Fees, and the Lightning Network (2025)

Instant Payments Europe: Rails, Fees, and the Lightning Network (2025)

Instant payments are fundamentally changing European commerce. This article explores the continent's real-time payment systems, from the underlying rails and regulatory frameworks to transaction fees and the future of financial technology built upon them.

Instant Payments Europe: Rails, Fees, and the Lightning Network (2025)

Brazil Real-Time Payments: Rails, Fees, and the Lightning Network (2025)

Brazil's real-time payment system has transformed its financial sector. This article examines the country's payment rails, the regulatory framework, associated fees, and the technical requirements for integration, offering a guide for businesses operating in the region.

Brazil Real-Time Payments: Rails, Fees, and the Lightning Network (2025)

Unlocking Smart Contracts on Bitcoin: DLCs, Covenants, and L2s Explained

Bitcoin, often recognized primarily as digital gold, possesses a far greater potential than simply a store of value or a medium of exchange. Its underlying technology is steadily evolving to support a robust ecosystem of decentralized applications and programmable money.

Unlocking Smart Contracts on Bitcoin: DLCs, Covenants, and L2s Explained

Unlocking Global Business Potential: A Guide to Multi-Currency Accounts

Multi-currency accounts unlock seamless management of global funds from one place—eliminating high fees and delays that hold businesses back. Now imagine combining that flexibility with the speed and efficiency of the Bitcoin Lightning Network. Together, they open the door to instant, low-cost payments across borders—built for the next century of money. In this guide, we’ll explore how multi-currency accounts and Lightspark’s infrastructure can help your business move faster, cut costs, and stay ahead in the digital economy.

Unlocking Global Business Potential: A Guide to Multi-Currency Accounts

Blockchain for Enterprise: Strategic Applications and Implementations For Banks

The financial industry stands at the precipice of a profound transformation, driven by technological advancements. Among these, blockchain technology has emerged as a particularly potent force, poised to redefine how banks operate, interact, and innovate. What exactly is enterprise blockchain, and how is it strategically reshaping the banking sector?

Blockchain for Enterprise: Strategic Applications and Implementations For Banks

Is Crypto Legal in Taiwan? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Taiwan requires a deep understanding of its evolving regulations. This article explores the compliance requirements, regulatory framework, historical context, and future outlook for digital assets in the region.

Is Crypto Legal in Taiwan? Regulations & Compliance in 2025

Is Crypto Legal in Panama? Regulations & Compliance in 2025

Panama's stance on cryptocurrency is a topic of significant interest for fintech leaders. This article explores the evolving legal landscape, delving into current regulations, compliance requirements, and the historical context shaping the nation's approach to digital assets.

Is Crypto Legal in Panama? Regulations & Compliance in 2025

Is Crypto Legal in Maldives? Regulations & Compliance in 2025

Understanding the legal status of cryptocurrency in the Maldives is essential for businesses and developers. This article delves into the nation's regulatory framework, compliance obligations, and the historical context shaping its digital asset policies.

Is Crypto Legal in Maldives? Regulations & Compliance in 2025

Is Crypto Legal in California? Regulations & Compliance in 2025

Is cryptocurrency legal in California? The answer is complex. This article explores the state's evolving regulatory landscape, offering insights into compliance requirements, historical context, and the future of digital assets for businesses operating within the Golden State.

Is Crypto Legal in California? Regulations & Compliance in 2025

Is Crypto Legal in Trinidad And Tobago? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Trinidad and Tobago presents unique challenges. This article explores the current regulations, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Trinidad And Tobago? Regulations & Compliance in 2025

Is Crypto Legal in Macedonia? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Macedonia presents unique challenges. This article delves into the country's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Macedonia? Regulations & Compliance in 2025

Is Crypto Legal in Kenya? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Kenya presents unique challenges. This article delves into the regulatory framework, compliance requirements, and historical context, providing a comprehensive overview for businesses and developers operating within the Kenyan fintech space.

Is Crypto Legal in Kenya? Regulations & Compliance in 2025

Is Crypto Legal in Belarus? Regulations & Compliance in 2025

Is cryptocurrency legal in Belarus? This article delves into the evolving landscape of digital assets in the country, exploring the historical context, current regulations, and compliance requirements for businesses operating within this complex legal environment.

Is Crypto Legal in Belarus? Regulations & Compliance in 2025

Is Crypto Legal in Afghanistan? Regulations & Compliance in 2025

Understanding the legal landscape of cryptocurrency in Afghanistan requires a deep dive into its complex regulatory environment. This article explores the historical context, current compliance requirements, and the evolving regulations shaping the future of digital assets in the region.

Is Crypto Legal in Afghanistan? Regulations & Compliance in 2025

Is Crypto Legal in Uganda? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Uganda presents unique challenges. This article explores the current regulations, compliance requirements, and historical context surrounding digital assets, providing a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Uganda? Regulations & Compliance in 2025

Is Crypto Legal in Estonia? Regulations & Compliance in 2025

Estonia's stance on cryptocurrency has evolved significantly. This article explores the current legal landscape, delving into compliance requirements, regulatory frameworks, and the historical context shaping the nation's approach to digital assets for businesses operating in the region.

Is Crypto Legal in Estonia? Regulations & Compliance in 2025

Is Crypto Legal in Lebanon? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Lebanon presents unique challenges. This article delves into the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Lebanon? Regulations & Compliance in 2025

Is Crypto Legal in Syria? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Syria presents unique challenges. This article explores the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Syria? Regulations & Compliance in 2025

Is Crypto Legal in Uzbekistan? Regulations & Compliance in 2025

Navigating the cryptocurrency landscape in Uzbekistan requires a clear understanding of its evolving legal framework. This article explores the nation's compliance requirements, regulatory nuances, and historical context to provide a comprehensive overview for businesses and developers.

Is Crypto Legal in Uzbekistan? Regulations & Compliance in 2025

Is Crypto Legal in Nevada? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Nevada requires a deep understanding of its evolving regulations. This article explores the state's approach to digital assets, covering compliance requirements, historical context, and the current regulatory framework for businesses.

Is Crypto Legal in Nevada? Regulations & Compliance in 2025

Is Crypto Legal in South Africa? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in South Africa requires a deep understanding of its evolving regulations. This article explores the compliance requirements, regulatory framework, historical context, and future outlook for digital assets in the country.

Is Crypto Legal in South Africa? Regulations & Compliance in 2025

Is Crypto Legal in Cuba? Regulations & Compliance in 2025

The legal status of cryptocurrency in Cuba is a nuanced topic for fintech leaders. This article explores the island's evolving regulations, compliance requirements, and historical context, providing a comprehensive overview for operating within its unique financial landscape.

Is Crypto Legal in Cuba? Regulations & Compliance in 2025

Is Crypto Legal in Cameroon? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Cameroon presents unique challenges. This article explores the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Cameroon? Regulations & Compliance in 2025

Is Crypto Legal in Dominican Republic? Regulations & Compliance in 2025

Navigating the cryptocurrency landscape in the Dominican Republic requires understanding its legal status. This article explores the nation's evolving regulations, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Dominican Republic? Regulations & Compliance in 2025

Is Crypto Legal in Peru? Regulations & Compliance in 2025

Navigating Peru's cryptocurrency landscape demands a clear understanding of its legal status. This guide examines the evolving regulations, compliance requirements, and historical context for businesses operating within the region's dynamic fintech sector.

Is Crypto Legal in Peru? Regulations & Compliance in 2025

Is Crypto Legal in Malta? Regulations & Compliance in 2025

Malta, the "Blockchain Island," presents a complex regulatory environment for digital assets. This article explores its legal framework, delving into the historical context, current regulations, and compliance obligations for businesses operating within the crypto space.

Is Crypto Legal in Malta? Regulations & Compliance in 2025

Is Crypto Legal in Moldova? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Moldova presents unique challenges. This article explores the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Moldova? Regulations & Compliance in 2025

Is Crypto Legal in New York? Regulations & Compliance in 2025

Navigating New York's cryptocurrency landscape requires a deep understanding of its unique legal framework. This article explores the state's compliance requirements, evolving regulations, and the historical context shaping the digital asset industry for businesses and developers.

Is Crypto Legal in New York? Regulations & Compliance in 2025

Is Crypto Legal in Fiji? Regulations & Compliance in 2025

Understanding the legal status of cryptocurrency in Fiji is a key consideration for market entry. This article explores the nation's digital asset regulations, compliance framework, and historical context, offering a comprehensive overview of the current landscape.

Is Crypto Legal in Fiji? Regulations & Compliance in 2025

Is Crypto Legal in Mauritius? Regulations & Compliance in 2025

For fintech leaders eyeing Mauritius, understanding the local stance on cryptocurrency is essential. This article delves into the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses navigating this evolving digital asset landscape.

Is Crypto Legal in Mauritius? Regulations & Compliance in 2025

Is Crypto Legal in NH? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in New Hampshire requires understanding its evolving regulations. This article explores the state's approach to digital assets, covering compliance requirements, historical context, and the current framework for businesses operating in the space.

Is Crypto Legal in NH? Regulations & Compliance in 2025

Is Crypto Legal in Ukraine? Regulations & Compliance in 2025

Navigating the legal status of cryptocurrency in Ukraine requires a look into its evolving regulatory landscape. This article explores the historical context, current compliance requirements, and the future of digital asset regulation within the country for businesses.

Is Crypto Legal in Ukraine? Regulations & Compliance in 2025

Is Crypto Legal in Venezuela? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Venezuela presents unique challenges. This article explores the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Venezuela? Regulations & Compliance in 2025

Is Crypto Legal in Myanmar? Regulations & Compliance in 2025

Is cryptocurrency legal in Myanmar? This question presents a complex challenge for fintech leaders. This article delves into the evolving regulatory landscape, historical context, and compliance requirements for digital assets within the Southeast Asian nation to provide clarity.

Is Crypto Legal in Myanmar? Regulations & Compliance in 2025

Is Crypto Legal in Iraq? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Iraq presents unique challenges. This article explores the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Iraq? Regulations & Compliance in 2025

Is Crypto Legal in Hawaii? Regulations & Compliance in 2025

Navigating Hawaii's cryptocurrency landscape requires a deep understanding of its unique regulatory environment. This article explores the state's approach to digital assets, covering compliance requirements, the evolution of regulations, and the historical context shaping its current legal framework.

Is Crypto Legal in Hawaii? Regulations & Compliance in 2025

Is Crypto Legal in Brazil? Regulations & Compliance in 2025

Understanding the legal landscape of cryptocurrency in Brazil is vital for any fintech operation. This article explores the nation's evolving regulations, compliance requirements, and the historical context shaping its digital asset framework, providing a comprehensive overview for innovators.

Is Crypto Legal in Brazil? Regulations & Compliance in 2025

Is Crypto Legal in Kazakhstan? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Kazakhstan requires a deep understanding of its evolving regulations. This article explores the compliance requirements, historical context, and current legal framework for digital assets to provide clarity for businesses and developers.

Is Crypto Legal in Kazakhstan? Regulations & Compliance in 2025

Is Crypto Legal in Algeria? Regulations & Compliance in 2025

Navigating Algeria's cryptocurrency landscape requires a deep understanding of its legal framework. This article explores the nation's current regulations, compliance requirements, and the historical context shaping its approach to digital currencies.

Is Crypto Legal in Algeria? Regulations & Compliance in 2025

Is Crypto Legal in Romania? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Romania requires understanding its evolving regulations. This article explores the compliance requirements, historical context, and current legal framework for digital assets to provide clarity for businesses and developers operating in the region.

Is Crypto Legal in Romania? Regulations & Compliance in 2025

Is Crypto Legal in Portugal? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Portugal requires understanding its evolving regulations. This article explores the compliance requirements, regulatory framework, historical context, and future outlook for digital assets within the country's financial system.

Is Crypto Legal in Portugal? Regulations & Compliance in 2025

Is Crypto Legal in Iran? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Iran presents unique challenges. This article delves into the nation's evolving regulations, historical context, and compliance requirements for businesses operating in the digital asset space, offering a comprehensive overview.

Is Crypto Legal in Iran? Regulations & Compliance in 2025

Is Crypto Legal in Denmark? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Denmark requires a detailed understanding of its regulatory framework. This article explores the nuances of compliance, the evolution of regulations, and the historical context shaping Denmark's approach to digital assets.

Is Crypto Legal in Denmark? Regulations & Compliance in 2025

Is Crypto Legal in Poland? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Poland presents unique challenges. This article delves into the country's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses operating in the digital asset space.

Is Crypto Legal in Poland? Regulations & Compliance in 2025

Is Crypto Legal in Jordan? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Jordan requires a nuanced understanding of its regulatory environment. This article explores the nation's compliance standards, historical context, and specific regulations to provide clarity on this complex subject.

Is Crypto Legal in Jordan? Regulations & Compliance in 2025

Is Crypto Legal in Bhutan? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Bhutan demands a nuanced understanding of its regulatory environment. This article explores the kingdom's approach to digital assets, covering compliance, historical context, and the evolving framework for fintech innovation.

Is Crypto Legal in Bhutan? Regulations & Compliance in 2025

Is Crypto Legal in Ethiopia? Regulations & Compliance in 2025

Navigating Ethiopia's cryptocurrency landscape requires a clear understanding of its evolving legal framework. This article explores the nation's stance on digital assets, covering compliance requirements, current regulations, historical context, and the implications for fintech innovation.

Is Crypto Legal in Ethiopia? Regulations & Compliance in 2025

Is Crypto Legal in Bahrain? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Bahrain requires a deep understanding of its regulatory framework. This article explores the nuances of compliance, the historical context of digital assets, and the specific regulations governing their use in the kingdom.

Is Crypto Legal in Bahrain? Regulations & Compliance in 2025

Is Crypto Legal in Finland? Regulations & Compliance in 2025

Is cryptocurrency legal in Finland? This article delves into the Finnish regulatory landscape for digital assets, exploring compliance requirements, the evolution of regulations, and the historical context to provide a comprehensive overview for businesses and developers in the space.

Is Crypto Legal in Finland? Regulations & Compliance in 2025

Is Crypto Legal in Georgia? Regulations & Compliance in 2025

Is cryptocurrency legal in Georgia? The answer is complex. This guide delves into the state's regulatory environment, compliance obligations, historical precedents, and what the future may hold for digital assets, providing clarity for businesses and developers.

Is Crypto Legal in Georgia? Regulations & Compliance in 2025

Is Crypto Legal in Cyprus? Regulations & Compliance in 2025

Understanding the legality of cryptocurrency in Cyprus is essential for fintech operations. This article examines the nation's evolving regulatory landscape, covering compliance requirements, historical context, and the future of digital assets for businesses in the region.

Is Crypto Legal in Cyprus? Regulations & Compliance in 2025

Is Crypto Legal in Belgium? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Belgium requires a deep understanding of its evolving regulations. This article explores the compliance requirements, historical context, and current regulatory framework to provide clarity for businesses in the digital asset space.

Is Crypto Legal in Belgium? Regulations & Compliance in 2025

Is Crypto Legal in Austria? Regulations & Compliance in 2025

Navigating Austria's cryptocurrency landscape requires a clear understanding of its legal framework. This article explores the nation's approach to digital assets, covering compliance requirements, evolving regulations, the historical context, and what it means for business operations.

Is Crypto Legal in Austria? Regulations & Compliance in 2025

Is Crypto Legal in Norway? Regulations & Compliance in 2025

The legal standing of cryptocurrency in Norway is a nuanced subject for fintech professionals. This article examines the country's regulatory environment, compliance standards, and historical precedents, offering a detailed analysis for businesses navigating the digital asset landscape.

Is Crypto Legal in Norway? Regulations & Compliance in 2025

Is Crypto Legal in Croatia? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Croatia requires a deep understanding of its regulatory framework. This article explores the compliance requirements, evolving regulations, and historical context shaping the future of digital assets in the country.

Is Crypto Legal in Croatia? Regulations & Compliance in 2025

Is Crypto Legal in Sri Lanka? Regulations & Compliance in 2025

The legal status of cryptocurrency in Sri Lanka presents a complex picture for fintech innovators. This article examines the country's regulatory framework, compliance demands, and the historical context shaping its current approach to digital assets.

Is Crypto Legal in Sri Lanka? Regulations & Compliance in 2025

Is Crypto Legal in Argentina? Regulations & Compliance in 2025

Is cryptocurrency legal in Argentina? For businesses and innovators, the answer is nuanced. This article explores the nation's regulatory framework, compliance obligations, historical context, and the evolving landscape for digital assets to provide comprehensive clarity on the matter.

Is Crypto Legal in Argentina? Regulations & Compliance in 2025

Is Crypto Legal in Serbia? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Serbia requires a detailed understanding of its evolving regulations. This article explores the compliance requirements, regulatory framework, historical context, and future outlook for digital assets within the country.

Is Crypto Legal in Serbia? Regulations & Compliance in 2025

Is Crypto Legal in Tunisia? Regulations & Compliance in 2025

The legal status of cryptocurrency in Tunisia is a key consideration for those in its fintech sector. This article explores the evolving regulatory framework, compliance requirements, and historical context to provide a comprehensive overview of the situation.

Is Crypto Legal in Tunisia? Regulations & Compliance in 2025

Is Crypto Legal in Mexico? Regulations & Compliance in 2025

Navigating Mexico's cryptocurrency landscape requires a clear understanding of its legal framework. This article explores the evolving regulations, compliance requirements, and historical context, offering clarity on the current state of digital assets for businesses operating in the region.

Is Crypto Legal in Mexico? Regulations & Compliance in 2025

Is Crypto Legal in Albania? Regulations & Compliance in 2025

Navigating Albania's cryptocurrency landscape requires a clear understanding of its evolving legal framework. This article explores the current regulations, compliance requirements, and historical context for businesses operating in the digital asset space, offering clarity on this complex topic.

Is Crypto Legal in Albania? Regulations & Compliance in 2025

Is Crypto Legal in Bulgaria? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Bulgaria requires a nuanced understanding of its evolving regulations. This article explores the compliance requirements, historical context, and current legal framework for digital assets, providing key insights for operating in the region.

Is Crypto Legal in Bulgaria? Regulations & Compliance in 2025

Is Crypto Legal in Israel? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Israel requires a deep understanding of its regulatory framework. This article explores the nation's evolving compliance requirements, historical context, and the current status of digital assets for businesses and developers.

Is Crypto Legal in Israel? Regulations & Compliance in 2025

Is Crypto Legal in Azerbaijan? Regulations & Compliance in 2025

Understanding the legal status of cryptocurrency in Azerbaijan is essential for operating in the region. This article explores the nation's evolving regulatory framework, compliance requirements, and historical context to provide a comprehensive and actionable overview.

Is Crypto Legal in Azerbaijan? Regulations & Compliance in 2025

Is Crypto Legal in Hungary? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Hungary presents unique challenges. This article delves into the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Hungary? Regulations & Compliance in 2025

Is Crypto Legal in Cambodia? Regulations & Compliance in 2025

Navigating Cambodia's cryptocurrency landscape requires a clear understanding of its evolving legal framework. This article explores the key regulations, historical context, and compliance requirements for businesses, offering essential insights into this complex and developing financial sector.

Is Crypto Legal in Cambodia? Regulations & Compliance in 2025

Is Crypto Legal in Greece? Regulations & Compliance in 2025

Navigating the cryptocurrency landscape in Greece requires a deep understanding of its legal framework. This article explores the nation's approach to digital assets, covering compliance requirements, evolving regulations, the historical context, and what it means for your business.

Is Crypto Legal in Greece? Regulations & Compliance in 2025

Is Crypto Legal in Colombia? Regulations & Compliance in 2025

Understanding the legal status of cryptocurrency in Colombia is essential for fintech innovation. This article explores the nation's evolving regulatory framework, compliance obligations, and historical context to provide a clear overview for businesses in the digital asset space.

Is Crypto Legal in Colombia? Regulations & Compliance in 2025

Is Crypto Legal in Switzerland? Regulations & Compliance in 2025

Understanding the legal landscape of cryptocurrency in Switzerland is vital for innovation. This article explores the nation's regulatory framework, compliance requirements, and historical context, offering a comprehensive overview for navigating this evolving financial frontier.

Is Crypto Legal in Switzerland? Regulations & Compliance in 2025

Is Crypto Legal in Spain? Regulations & Compliance in 2025

The legal status of cryptocurrency in Spain presents a complex picture for fintech operators. This article delves into the regulatory landscape, compliance mandates, and historical context to provide a clear overview of operating within Spain's digital asset market.

Is Crypto Legal in Spain? Regulations & Compliance in 2025

Is Crypto Legal in Singapore? Regulations & Compliance in 2025

Is cryptocurrency legal in Singapore? For fintech leaders, understanding the nuances is essential. This article explores the evolving landscape of digital assets, covering compliance requirements, regulatory frameworks, historical context, and what the future may hold for the industry.

Is Crypto Legal in Singapore? Regulations & Compliance in 2025

Is Crypto Legal in Sweden? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Sweden requires a nuanced understanding of its regulatory framework. This article explores the key aspects of compliance, the evolution of regulations, and the historical context shaping Sweden's approach to digital assets.

Is Crypto Legal in Sweden? Regulations & Compliance in 2025

Is Crypto Legal in New Zealand? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in New Zealand presents unique challenges. This article delves into the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview of the current state of digital assets.

Is Crypto Legal in New Zealand? Regulations & Compliance in 2025

Is Crypto Legal in USA? Regulations & Compliance in 2025

Understanding the legal landscape of cryptocurrency in the United States is vital for innovation. This article explores the complex web of compliance, evolving regulations, and the historical context shaping the future of digital assets in the U.S.

Is Crypto Legal in USA? Regulations & Compliance in 2025

Is Crypto Legal in Italy? Regulations & Compliance in 2025

Navigating Italy's cryptocurrency landscape requires a clear understanding of its legal framework. This article explores the key regulations, compliance requirements, and historical context shaping the digital asset space for businesses operating within the country.

Is Crypto Legal in Italy? Regulations & Compliance in 2025

Is Crypto Legal in Ireland? Regulations & Compliance in 2025

Understanding the legal landscape of cryptocurrency in Ireland is essential for fintech innovators. This article delves into the nuances of compliance, evolving regulations, and the historical context shaping the digital asset space, providing a comprehensive overview.

Is Crypto Legal in Ireland? Regulations & Compliance in 2025

Is Crypto Legal in China? Regulations & Compliance in 2025

Navigating China's stance on cryptocurrency requires a deep understanding of its complex legal landscape. This article explores the evolving regulations, historical context, and compliance requirements for businesses operating in or adjacent to this dynamic market.

Is Crypto Legal in China? Regulations & Compliance in 2025

Is Crypto Legal in Pakistan? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Pakistan presents unique challenges. This article delves into the nation's evolving regulations, historical context, and compliance requirements to provide a comprehensive overview for businesses and developers operating in the region.

Is Crypto Legal in Pakistan? Regulations & Compliance in 2025

Is Crypto Legal in Thailand? Regulations & Compliance in 2025

For businesses operating in Southeast Asia, understanding Thailand's stance on cryptocurrency is key. This article explores the nation's evolving digital asset regulations, compliance frameworks, historical context, and the future of fintech within its borders.

Is Crypto Legal in Thailand? Regulations & Compliance in 2025

Is Crypto Legal in France? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in France requires understanding its evolving regulations. This article explores the key compliance requirements, historical context, and the current regulatory framework for digital assets operating within the country.

Is Crypto Legal in France? Regulations & Compliance in 2025

Is Crypto Legal in Kuwait? Regulations & Compliance in 2025

Navigating Kuwait's cryptocurrency landscape requires a deep understanding of its evolving legal framework. This article explores the key regulations, compliance requirements, and historical context for businesses operating in the region, offering clarity on the current financial technology environment.

Is Crypto Legal in Kuwait? Regulations & Compliance in 2025

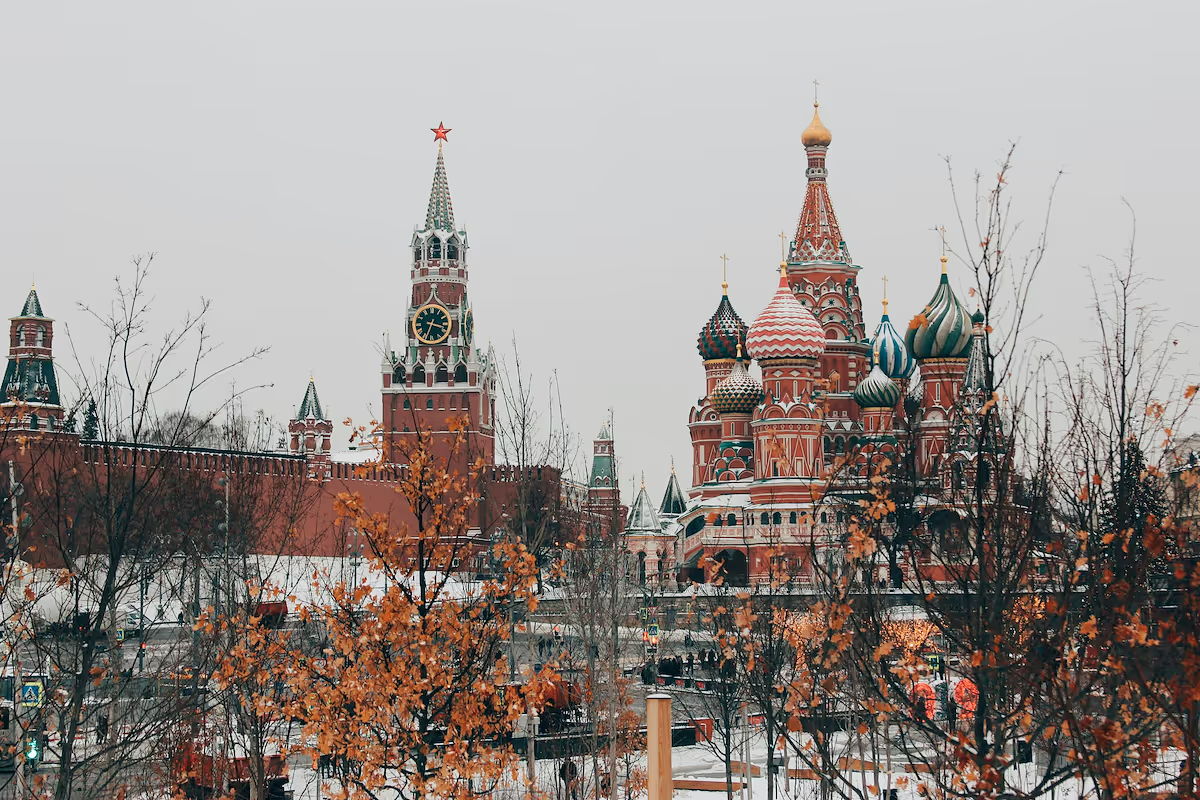

Is Crypto Legal in Russia? Regulations & Compliance in 2025

Navigating Russia's cryptocurrency landscape requires a deep understanding of its evolving legal framework. This article explores the key regulations, compliance requirements, and historical context, offering clarity for businesses operating in this complex and shifting environment.

Is Crypto Legal in Russia? Regulations & Compliance in 2025

Is Crypto Legal in Oman? Regulations & Compliance in 2025

Understanding the legal status of cryptocurrency in Oman is essential for market entry and operations. This article delves into the nation's regulatory stance, compliance mandates, and the historical context shaping its approach to digital assets.

Is Crypto Legal in Oman? Regulations & Compliance in 2025

Is Crypto Legal in Hong Kong? Regulations & Compliance in 2025

Understanding the legal status of cryptocurrency in Hong Kong is essential for operating in the region. This article delves into the city's evolving regulations, compliance requirements, and historical context to provide a comprehensive and actionable overview.

Is Crypto Legal in Hong Kong? Regulations & Compliance in 2025

Is Crypto Legal in Germany? Regulations & Compliance in 2025

Navigating Germany's cryptocurrency landscape requires a deep understanding of its legal framework. This article explores the key regulations, compliance requirements, and historical context shaping the digital asset space for businesses and developers operating within the country.

Is Crypto Legal in Germany? Regulations & Compliance in 2025

Is Crypto Legal in Philippines? Regulations & Compliance in 2025

Navigating the legality of cryptocurrency in the Philippines requires understanding its complex regulatory environment. This article explores the nation's digital asset compliance, current regulations, historical context, and the future of crypto within its financial system.

Is Crypto Legal in Philippines? Regulations & Compliance in 2025

Is Crypto Legal in Netherlands? Regulations & Compliance in 2025

Navigating the cryptocurrency landscape in the Netherlands requires a deep understanding of its legal framework. This article explores the key regulations, compliance requirements, and historical context shaping the digital asset space for businesses and developers in the region.

Is Crypto Legal in Netherlands? Regulations & Compliance in 2025

Is Crypto Legal in Bangladesh? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Bangladesh presents unique challenges. This article delves into the nation's regulatory framework, historical context, and compliance requirements for businesses operating within the region's evolving digital economy.

Is Crypto Legal in Bangladesh? Regulations & Compliance in 2025

Is Crypto Legal in Uk? Regulations & Compliance in 2025

Understanding the legal landscape of cryptocurrency in the United Kingdom is vital for innovation. This article delves into the UK's regulatory framework, compliance requirements, and the historical context shaping the future of digital assets in the region.

Is Crypto Legal in Uk? Regulations & Compliance in 2025

Is Crypto Legal in Ghana? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Ghana presents unique challenges. This article delves into the nation's regulatory framework, compliance requirements, and historical context to provide a comprehensive overview for businesses operating in the fintech space.

Is Crypto Legal in Ghana? Regulations & Compliance in 2025

Is Crypto Legal in Japan? Regulations & Compliance in 2025

For businesses navigating Japan's fintech space, the legality of cryptocurrency is a key question. This article explores the nation's regulatory framework, compliance standards, and the historical context that defines its approach to digital assets.

Is Crypto Legal in Japan? Regulations & Compliance in 2025

Is Crypto Legal in Morocco? Regulations & Compliance in 2025

Navigating Morocco's cryptocurrency landscape requires understanding its evolving legal framework. This article explores the key regulations, historical context, and compliance considerations for businesses, offering clarity on this complex and often ambiguous topic for fintech professionals.

Is Crypto Legal in Morocco? Regulations & Compliance in 2025

Is Crypto Legal in Malaysia? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Malaysia requires a nuanced understanding of its evolving regulations. This article explores the compliance requirements, regulatory frameworks, and historical context shaping the digital asset space for businesses and developers.

Is Crypto Legal in Malaysia? Regulations & Compliance in 2025

Is Crypto Legal in South Korea? Regulations & Compliance in 2025

Understanding the legality of cryptocurrency in South Korea requires navigating a dynamic regulatory environment. This article explores the compliance frameworks, key regulations, and historical context that define the digital asset landscape for businesses operating in the region.

Is Crypto Legal in South Korea? Regulations & Compliance in 2025

Is Crypto Legal in Australia? Regulations & Compliance in 2025

Navigating the legal landscape of cryptocurrency in Australia presents unique challenges. This article delves into the evolving regulations, compliance requirements, and historical context, providing a comprehensive overview for operating in the digital asset space.