If you're comparing payment APIs, you don't need a primer on what Stripe does. You need to know where it falls short for your use case—and whether newer infrastructure like Lightspark Grid solves those problems.

This comparison covers the evaluation criteria that matter for global money movement: settlement speed, cross-border coverage, currency flexibility, pricing transparency, and developer experience. We'll show where each platform excels and where the architectural differences create real gaps.

Evaluation Framework: What to Compare

Settlement Speed and Availability

The first question: how fast does money actually move, and when?

Stripe settles on traditional banking timelines. Standard payouts take 2 business days in most markets. Instant Payouts are available for an additional 1% fee (minimum $0.50), but only to eligible debit cards and bank accounts in supported countries. Settlement doesn't happen on weekends or banking holidays—if your customer pays on Friday evening, funds don't move until Monday.

Lightspark’s Grid settles in real-time by default. There's no "instant" tier because instant is the baseline. Payments settle 24/7/365, including weekends and holidays, using a combination of local instant rails and Bitcoin as a settlement layer. A payout initiated at 2 AM on a Sunday in Singapore settles in seconds, not when New York banks open Monday morning.

The difference matters for:

- Gig platforms paying workers immediately after job completion

- Marketplaces releasing funds to sellers in real-time

- Treasury operations that need to move liquidity outside banking hours

- Any product where settlement speed is part of the value proposition

Cross-Border Coverage and Rails

Country count is vanity. Rail coverage is what determines whether your users wait hours or days.

Stripe's cross-border payouts are limited to specific corridors. Platforms in the US, UK, EEA, Canada, and Switzerland can pay connected accounts in those same regions—but self-serve payouts to countries outside this list aren't supported. For everything else, you're directed to contact sales.

Within supported corridors, Stripe charges:

- 0.25% cross-border payout fee (waived for UK↔EEA and intra-EEA)

- 1% currency conversion for US accounts

- 2% currency conversion for non-US accounts

- Additional 1.5% for international cards, plus 1% if conversion is needed

International wire transfers through Stripe can take several business days and may incur intermediary bank fees, reducing the amount received.

Grid connects 65 countries through local instant payment rails

Bitcoin and stablecoin settlement works globally with no geographic restrictions. When you send a payout through Grid, it routes through the optimal path—local instant rails where available, Bitcoin settlement where it's faster or cheaper. Recipients get local currency in their bank accounts; they don't see or interact with crypto unless they want to.

The architectural difference: Stripe routes through correspondent banking, which means intermediary fees and multi-day settlement for many corridors. Grid uses Bitcoin as a settlement layer to bypass correspondent banking entirely, then settles locally via instant rails.

Currency and Asset Flexibility

Stripe handles fiat currencies through traditional payment methods. It supports 135+ currencies for payment acceptance and offers multi-currency pricing. But moving between currencies means paying conversion fees at each step, and there's no native support for stablecoins or cryptocurrency.

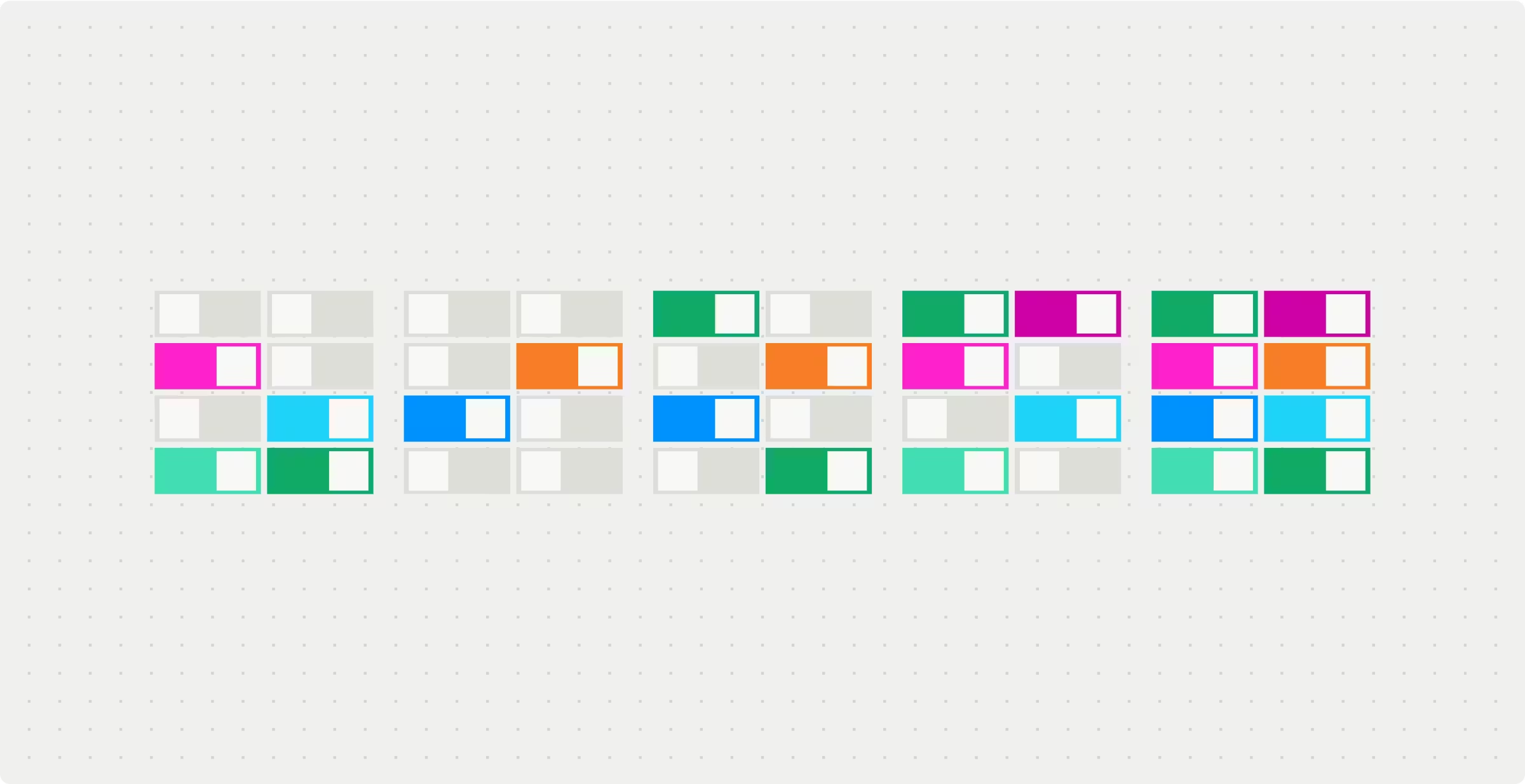

Grid treats fiat, stablecoins, and Bitcoin as interoperable through a single API. The quote system handles:

You specify the source and destination; Grid routes optimally. A user can pay in euros while your platform receives dollars. A contractor can choose to receive payment in local currency or stablecoins. This happens through one integration—not multiple payment method implementations stitched together.

For platforms exploring stablecoin treasury, crypto payouts, or multi-currency operations, Grid provides this flexibility without requiring separate crypto infrastructure.

Quote and Pricing

How fees are presented affects both your unit economics and user trust.

Stripe’s pricing is published on its website, but costs compound quickly across features. Base processing fees, international card surcharges, currency conversion markups, cross-border payout fees, and product-specific charges for Billing, Connect, Radar, and Instant Payouts all stack. For a cross-border transaction with currency conversion, total fees can reach several percentage points before any product add-ons.

Grid’s quote system takes a different approach. Before executing any payment, Grid returns a quote with the exact sending and receiving amounts, the locked exchange rate, and an itemized fee breakdown—so you know the total cost before committing. You can lock either the sending or receiving amount, and rates hold for a defined window. No hidden spreads, no embedded markups in the rate.

Compliance Infrastructure

Moving money globally means navigating KYC, AML, and licensing requirements.

With Stripe Connect, compliance responsibilities vary by account type. Standard connected accounts handle their own onboarding through Stripe. Custom and Express accounts require you to collect and pass identity information, with varying levels of Stripe-hosted vs. platform-managed verification. Expanding to new countries often requires additional integration work.

Grid offers two compliance paths:

Hosted KYC/KYB: For non-regulated platforms, Grid handles identity verification through hosted flows. Users complete verification through Grid's interface; you inherit the compliance stack. This dramatically reduces time-to-launch.

Bring your own: For regulated entities (banks, licensed fintechs), you handle KYC/KYB through your existing processes. Grid accepts your verified customers.

For rewards and payouts, only the paying entity needs KYB verification. You can send Bitcoin to any wallet address without requiring recipient KYC—useful for cashback programs, creator payouts, and promotional campaigns where recipient identity verification would kill conversion.

Developer Experience

You'll live with this integration. API quality matters.

Stripe's developer experience is mature. Years of iteration have produced comprehensive SDKs, extensive documentation, and a large community. The tradeoff: Stripe's breadth means complexity. Different products (Payments, Connect, Billing, Invoicing, Treasury, Issuing) have different APIs, objects, and patterns. Building a global payout flow often means integrating multiple products with different mental models.

Grid takes a "commands for money" approach. The API surface is unified—send, receive, convert, hold balances, run payouts through modular primitives that compose together. Rather than integrating separate products for payouts vs. collections vs. FX, you work with one API.

Grid's developer resources:

The sandbox is worth calling out: you can test complete cross-border flows—quote creation, funding, settlement—without moving real funds. This isn't always true of payment API sandboxes.

Architecture: Why the Differences Exist

The capability gaps stem from architectural choices made years ago.

Stripe was built to accept card payments online. It does this exceptionally well. But card networks and ACH weren't designed for real-time global settlement. When Stripe added cross-border payouts, international transfers, and multi-currency support, it built on top of correspondent banking—the same infrastructure that makes wire transfers slow and expensive.

Grid was built for global money movement from day one. It uses Bitcoin and the Lightning Network as a settlement layer—not because users need to interact with crypto, but because Bitcoin provides 24/7, near-instant, low-cost settlement that traditional rails can't match. Grid then connects to local instant payment systems (PIX, SEPA Instant, UPI, Faster Payments) for last-mile delivery.

The result: Grid can offer real-time settlement to 65 countries through one API because it bypasses the correspondent banking system that creates delays and fees in traditional infrastructure.

This is invisible to end users. A Brazilian contractor receives reais via PIX. A UK seller gets pounds via Faster Payments. They don't know Bitcoin was involved—they just know the money arrived in seconds instead of days.

When to Choose Each

Stripe is the right choice if:

- Your primary need is to accept card payments from customers

- You operate mainly in one country or region

- You need mature subscription billing and invoicing

- Settlement speed isn't a competitive differentiator

- Your cross-border volume is limited to Stripe's supported corridors

Grid is the right choice if:

- You need real-time payouts across multiple countries

- Cross-border settlement speed and cost affect your unit economics

- You're building for a global user base from day one

- You want fiat/stablecoin/Bitcoin interoperability through one API

- You need to add new payment corridors without new integrations

- You're a neobank, marketplace, wallet, or platform where money movement is core to the product

Many companies use both: Stripe for card acceptance and checkout, and Grid for global payouts and cross-border settlement. The APIs serve different parts of the money movement stack.

Getting Started with Grid

Grid offers a full sandbox environment that mirrors production. Test quote creation, funding flows, and settlement without moving real funds.

To start integrating:

If you're evaluating global payment infrastructure, the question isn't whether Stripe is good—it's whether infrastructure built for card acceptance can solve problems that require real-time global settlement. For an increasing number of use cases, the answer is no.